How is Stratzy Changing the Algo Trading Game?

Algo trading has grown popular in India thanks to its promise of fast, unbiased, and rule-based trading. Yet, many platforms are either too complex or tailored only for professionals. Stratzy, a Mumbai-based FinTech platform, is quietly changing this game. It offers algo-based tools and research that blend simplicity with structure, helping everyday investors and traders access strategies that were once available only to institutions.

In this article, we will explore how Stratzy is reshaping the algo trading landscape in India, focusing on what it does well and where it still has limitations.

How Is Stratzy Changing the Algo Trading Space?

Here are some of the features of the Stratzy algo trading platform you must be aware of:

SEBI-Registered

Stratzy operates as a SEBI-registered Research Analyst (RA), providing recommendations and algorithmic strategies developed in-house under regulatory compliance. This formal approval brings accountability and reassures users about its legitimacy.

Moreover, Stratzy isn’t a global tool awkwardly adapted for India. Its strategies are built on Indian market data (NSE/BSE), designed with SEBI rules in mind, and integrated with local brokers.

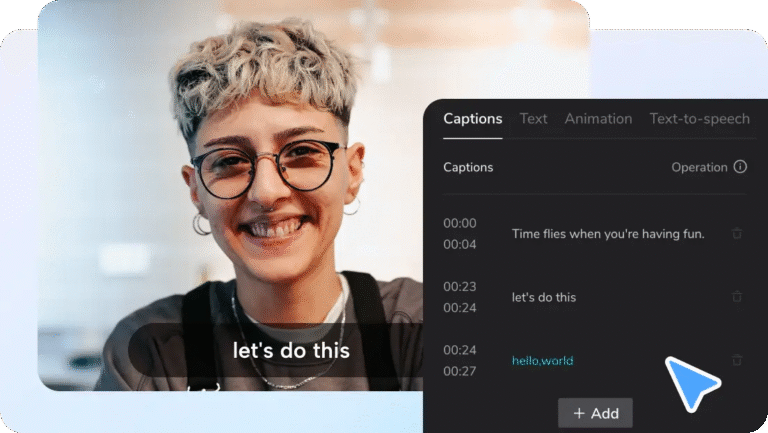

No-Code Strategy

Strathy aims to simplify algorithmic trading. You don’t need to code. Instead, you choose from prebuilt strategies, connect your broker, and let the platform handle execution. This contrasts with traditional algo platforms, where coding and technical setup are mandatory.

For everyday Indian investors, that means your money stays in your brokerage account, there’s no lock-in, and you can start with as little as ₹100.

Chakra-Inspired

Stratzy’s unique selling point is its 108-alpha “chakra pool”. This collection of independent strategies is designed for low correlation and diversity, inspired by the symbolic Indian concept of chakras.

Through its “chakra” philosophy, Stratzy offers a thoughtful mix of strategy types:

- Rule-based strategies like momentum breakouts, mean reversion, options spreads, and volatility signals, all with clear rules, backtested performance, and defined risk limits.

- A personalised subset of 10–20 alphas selected for your capital level and risk appetite. These have undergone thousands of stress-test simulations to withstand various market conditions.

This approach combines ancient Indian symbolism with modern quant methods, aiming for discipline, balance, and diversification.

Automation with Control

Stratzy offers automatic algo execution; you choose to automate or manually follow ideas. Once connected, strategies can run automatically across positional, swing, and spot trades with risk-management controls like stop-loss and rebalancing built in.

It also provides near real-time tracking of metrics like mark-to-market, drawdown, and profit and loss in a dashboard.

Transparency

Stratzy shares performance summaries and per-trade results. However, unlike some competitors, it does not offer backtesting or paper-trading simulations before you deploy real money. You can’t test strategies with virtual capital first.

Challenges with Stratzy

While Stratzy offers multiple perks to its users, there is also a flip side that you must not ignore:

- Stratzy’s strategies are largely based on backtested results. However, live market conditions can differ drastically from historical data.

- There may be delays between alert generation and trade execution. Rapid clicks or poor network conditions could also trigger multiple orders unintentionally.

- Trade execution depends on third parties: brokers, exchange systems, and internet connectivity. Any failure in these can prevent execution or result in execution errors.

- Some users have reported discrepancies in profit-and-loss reporting. Trades that have been closed may still appear as open, and alerts to close positions might persist.

Conclusion

Stratzy is quietly redefining algo trading in India. Its chakra-inspired alpha pool is thoughtful, and its broker support and real-time dashboard make execution and tracking smoother.

That said, its simplicity comes at the expense of customisation and pre-deployment validation. Users must accept live execution based on past results without testing first.