Ashcroft Capital Lawsuit: What Investors Need to Know Now

Potentially profitable prospects can provide investors with unanticipated dangers, but investors are perpetually seeking out such opportunities. Many people in the investing world are curious about the implications of the recent Ashcroft Capital lawsuit for their own portfolios. It is critical that you comprehend the case’s ramifications and how they may influence your financial future when new data become available.

In this blog article, we will explore the circumstances behind this court dispute and the increasing significance of its outcome. No matter your level of experience as an investor, remaining educated is key to navigating these challenging times. Learn the ins and outs of the Ashcroft Capital Lawsuit case so you can make an informed investment decision.

The Lawsuit Against Ashcroft Capital

There has been a lot of buzz among investors about the case involving Ashcroft Capital Lawsuit. Former investors have filed a lawsuit claiming fraud and multiple breaches of fiduciary duty.

The claimants say that incomplete information about the dangers of their investments was given to them. People are worried about the financial losses that may have occurred due to the lack of openness.

Critical problems surrounding investor rights and corporate responsibility are being brought to light as more about the case emerge. Because of the potential impact on confidence in the real estate investment market, many are watching the progress of this court dispute with great interest.

Addressing these claims and rebuilding confidence among stakeholders would heavily rely on Ashcroft Capital’s response. Other businesses may be able to use the result as a guide when they encounter comparable problems. With the case’s future still clouded in mystery, investors have no idea what this implies for their investments.

Impact on Investors and Their Investments

Many investors are worried about the Ashcroft Capital lawsuit. Many are concerned about the possible impact on their returns and other financial matters.

Investors frequently put their faith in investments that are stable and trustworthy. Uncertainty can ensue if that basis is shaken by legal challenges. Some people might feel forced to reevaluate their investments or perhaps sell off assets just to be safe.

Investors with a large stake in Ashcroft Capital Lawsuit may see their distributions postponed or decreased as a result of this action. The confidence of investors and the value of shares could be affected if the general public’s opinion changes.

More than just a financial problem, such legal matters might have far-reaching consequences. It can also change your connection with your partners and lenders, making it harder to get money in the future. Traders and investors need to keep a sharp eye on the market as events unfold.

You May Like : Laaster: A Blend of Tradition and Innovation in Technology

Steps Taken by Ashcroft Capital to Address the Lawsuit

In light of the recent litigation, Ashcroft Capital has taken the initiative to respond. Keeping investors informed and open is a top priority for the management team.

As a first step in dealing with the complex charges, they have retained legal representation. This guarantees that they are well-prepared and have a strong defence.

Ashcroft Capital Lawsuit has also ramped up its outreach initiatives. For investors who would like more information, they are hosting webinars and question and answer sessions.

Compliance reviews are also highly valued by the organisation in all areas of operation. By taking this action, they want to show that they are serious about continuing to operate ethically.

Press releases are being used to keep the public informed on a regular basis. In times of uncertainty, keeping stakeholders informed is essential for maintaining confidence.

What Investors Can Do in Response to the Lawsuit

Staying proactive is key for investors who are facing uncertainty as a result of the Ashcroft Capital litigation. Keeping abreast on current events is the first order of business. The possible effect on investments can be better assessed with the help of regular updates.

Working with financial consultants can help shed light on the situation. Based on each client’s unique portfolio and risk tolerance, experts can provide personalised recommendations.

Building relationships with other investors could be useful as well. In times of difficulty, it helps to have a network of people who can listen and offer advice.

In the absence of doing so, you should think about portfolio diversification. To lessen the blow of this lawsuit, investors can diversify their holdings across industries or types of assets.

Keep discussions going with Ashcroft Capital Lawsuit. Gaining a grasp of their approaches to resolving the legal issues could offer comfort and light on their future plans.

Lessons Learned from the Ashcroft Capital Lawsuit

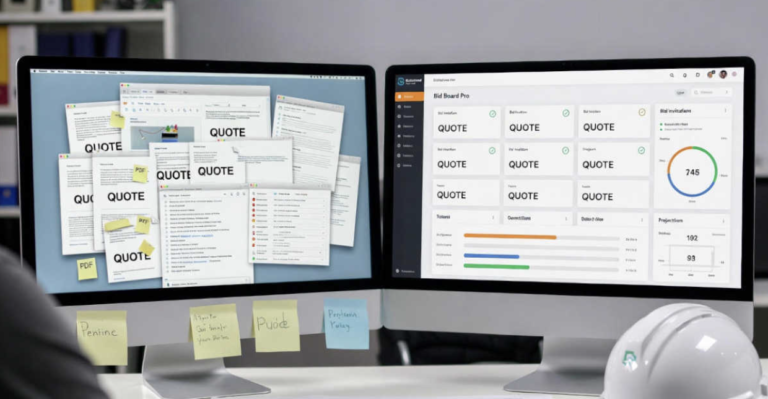

Thorough due diligence is crucial, as seen in the Ashcroft Capital Lawsuit. Both the financial statements and the management procedures that led up to those numbers should be carefully examined by investors.

In investing relationships, transparency is key. This instance demonstrates how serious problems with trust can arise between companies and investors due to a lack of information.

When a crisis occurs, it is crucial to communicate. Silence can lead to conjecture and anxiety, therefore it’s important for companies to keep their stakeholders informed.

We must not ignore ethical principles. Beyond the obvious legal ramifications, unethical actions can ruin reputations and take a long time to repair.

Investors would do well to remember the need of diversification in light of this predicament. When unanticipated events happen, the risks might be magnified if one company or industry is overly dependent on the others.

Conclusion

Most people are very worried about the Ashcroft Capital lawsuit, including investors. Everybody engaged with or thinking about putting money into Ashcroft Capital assets has to know what this means.

The company’s communications regarding its steps to address these issues should be properly monitored, and investors should stay updated about any further events surrounding the lawsuit. One way to gain insight into how this situation can influence your investing plans is to consult with financial experts.

The story highlights the significance of doing one’s homework before investing in real estate and the difficulties that come with it. Regardless of the investing situation, overcoming such obstacles requires open and honest communication as well as proactive measures.

Keeping oneself informed allows investors to make wise choices in the face of uncertainties such as the Ashcroft Capital lawsuit.

Read More : Twizchat com: Secure Minimal Chat & Real-Time Collaboration